Cultured meat: the future of food is slaughter-free

The world was taken aback when the first cultured meat burger – unfairly dubbed ‘Frankenmeat’- was unveiled and tested nine years ago.

How could meat be grown in a lab, instead of coming directly from an animal? Many thought that this was the perfect example of ‘science gone mad’. But this wasn’t scientists playing God, rather they were looking at alternatives to meat production that wouldn’t have the disastrous impact that factory farming, which is responsible for over 18% of greenhouse gas emissions, has on the environment. Scientists were also looking at solutions to combat world hunger and move the industry away from the cruel practices of intensive farming.

In less than a decade huge strides have been made in the cellular agriculture space. These days there are several start-ups producing cultured meat – including beef, pork, chicken, foie gras; fish and seafood, such as salmon, oysters and now even eel. Lately, even cell-based honey and milk start-ups have debuted in this space.

From university labs to start-ups

Many would assume cultured meat was born on 5 August 2013 when Maastricht University professor and scientist Mark Post unveiled the first burger made from lab-grown bovine cells at a conference in London. The patty was cooked and tasted at the event, receiving positive feedback for taste, texture and mouthfeel. The first cultured meat burger cost $330,000 (£285,200) to make. An anonymous donor, later revealed to be Google co-founder Sergey Brin, financed the operation.

But the history of cultured meat goes back several years. In 2002 a professor at Touro College in the US, Morris Benjaminson and his team, fed growth media, specifically foetal bovine serum, to sections of muscles taken from goldfish. After around a week, they’d noticed that the samples had grown by 14%. Funded by NASA, the project was researching novel ways for astronauts to grow food in space, rather than trying to find a solution to cut greenhouse gas emissions. The project inspired Jason Matheny, who at the time was studying a Master’s in public health at Johns Hopkins University.

Three years before, bio artists Oron Catts and Ionat Zurr successfully grew semi living steaks from pre-natal sheep cells during a residency at Harvard Medical School. The project later developed into the Disembodied Cuisine, part of the exhibition L’Art Biotech in Nantes, France, in which a performance artist ate semi-living frog steaks that were grown in-vitro using cells taken from the amphibian.

But even earlier than that, Dutch businessman Willem Van Eelen, also known as the godfather of cultured meat, managed to secure $750,000 from investors and obtain the patent for in-vitro meat production in 1995. It would take him another six years before approaching Henk Haagsman, professor of Meat Science at Utrecht University.

Van Eelen and Haagsman managed to raise €2M to fund a four-year project ran by Utrecht, Amsterdam, and Eindhoven universities. Mark Post and Peter Vestrate who later went on to found one of the most famous cultured meat start-ups, Mosa Meat, were part of the team.

Haagsman, Van Eeelen, Post and Vestrate weren’t the only scientists working on cultured meat, or, as it was called then, in-vitro meat. The Chalmers University of Technology University in Gothenburg and the Norwegian University of Life Sciences also undertook projects growing animal cells in laboratories and designing bioreactors to grow stem cells, as well as Vladimir Mironov, at the Medical University of South Carolina (MUSC) and Douglas McFarland of South Dakota State in the US who were conducting projects on in-vitro meat.

Mironov, McFarland and fellow scientists P.D. Edelman from South Dakota State University and the aforementioned Jason Matheny co-authored the first review article on cell-based meat in 2005, Commentary: In Vitro-Cultured Meat Production, in which they stated: “Relative to conventional meat, cultured meat could offer a number of benefits. With cultured meat, the ratio of saturated to polyunsaturated fatty acids could be better controlled; the incidence of foodborne disease could be significantly reduced; and resources could be used more efficiently, as biological structures required for locomotion and reproduction would not have to be grown or supported. Whether or not cultured meat is economically practical is a different question. A number of tissue engineers have speculated on its prospects.”

Seeing cultured meat as an alternative to factory farming, PETA also got involved. In an article by Neil Stephens from Brunel University, Alexandra E. Sexton from Oxford University and Wageningen University’s Clemens Driessen, part of the Cellular Agriculture: Biotechnology for Sustainable Food research, published in Frontiers, the authors write: “…in 2008 People for the Ethical Treatment of Animals (PETA) offered $1m for the first group to sell in-vitro chicken that was indistinguishable from livestock chicken in 10 US states. The campaign was fronted by PETA President Ingrid Newkirk, although a key driver of the campaign within PETA was Bruce Friedrich, who later co-established CM [cultured meat] and plant-based meats advocacy group the Good Food Institute (GFI). Scientists within the CM community at the time felt the prize was a little gimmicky, as no one was close to producing tissue at that quantity or quality. Their preference would be to invest the money in a grant, which PETA subsequently did, funding Nicolas Genovese (who would later co-found Memphis Meats) to work with Mironov at MUSC on their “Charlem” (Charleston-engineered-meat) approach. Other third-sector groups were also active, including van Eelen’s own in-vitro Meat Foundation, and Austria-based Future Foods. By 2013, New Harvest [a non-profit research institute that supports open, public cultured meat research founded by Jason Matheny in 2004] had attracted sufficient funds to take on its first employee, its Executive Director Isha Datar, who steered the organization as the CM communities of the first wave transitioned into the second.”

In 2008 the first In-Vitro Meat Symposium was held at the Norwegian Food Research Institute in Norway.

In 2015 New Harvest hosted the 1st International Symposium on Cultured Meat at Maastricht University and a year later the institute held the New Harvest Conference in San Francisco. More events followed in Israel, Japan and the UK, marking a clear interest and progress in the cultured meat space.

This new wave of scientists, looking into the production and viability of cultured meat, went on to inspire several people, who eventually founded start-ups, such as Shir Friedman, Head of Operations at Israeli cultured chicken company SuperMeat.

“When I heard about cultivated meat, I thought, this sounds absolutely crazy,” Shir tells me over Zoom. “But if it’s doable, then it’s amazing, it’s absolutely brilliant. So I went to get a degree in biology, just so I could understand a little bit more about what was going on, if it was even possible [to grow meat in a lab]. I got to meet my two other co-founders [Ido Savir and Koby Barak] from SuperMeat. And that’s kind of how things rolled into what we have right now.”

Cultured meat was now expanding beyond university walls, and the first start-ups were born. Modern Meadow, the first cultured meat start-up was launched in the US in 2011, with Memphis Meats (later renamed Upside Foods), SuperMeat, Finless Foods, Mark Post and Peter Verstrate’s Mosa Meat, Aleph Farms, Future Meat and Eat Just following a few years later.

In 2019 a group of American start-ups, including Eat Just, Finless Foods and Memphis Meat, founded the Alliance for Meat, Poultry & Seafood Innovation. Two years later start-ups from Europe and Israel, comprising Mosa Meat, SuperMeat, Aleph Farms, Meatable, Future Meat, Ivy Farm, Bluu Biosciences, Cubiq Foods, Peace of Meat (later bought by MeaTech), Gourmey, Higher Steak, and Vital Meat formed the Cellular Agriculture Europe to bring together start-ups and open a dialogue with consumers and regulators.

2020 was a pivotal year for cultured meat. The Singapore Food Agency approved the first cultured meat product for sale and Josh Tetrick’s Eat Just’s cultivated chicken was put on the menu of restaurant 1880. Today Singapore is still the only country that has approved the sale of lab-grown meat.

Investors working in the agri-foodtech and sustainability spaces started taking notice, with investment companies and VCs such as Happiness Capital, Allusion One, CPT Capital and Better Bite Ventures, Manta Ray, ADM Ventures and CULT Food Science – whose portfolio includes Eat Just Inc, Mogale Meat, MeliBio, Perlita Foods, Novel Farms Inc. and Umami Meats among others – pouring capital into cultured food start-ups.

What is cultured meat and how is it made?

Cultured meat (including fish and seafood) is made by growing animal cells in a lab. To take a cell sample, a biopsy is done on a live animal under local anaesthetic, then, the harvested stem cells are fed a growth medium containing amino acids, glucose, salt, vitamins and other nutrients and grown in a bioreactor. The cells multiply creating muscle tissue, which are then turned into the scaffolding of the final product, for instance a beef steak or a burger. The scaffolds are predominantly collagen and gelatine and help give the final product its texture and structure.

To grow beef, a cell sample must be taken from a cow, to create cultivated chicken, it must be taken from chicken, lab-grown salmon needs cells from salmon and so forth.

Those who’ve tasted cultured meat and fish say that they are exactly like their counterpart from slaughtered animals. In terms of nutrition, they contain similar macronutrients and micronutrients, depending on the cultivated product.

SuperMeat believe its the only start-up that has published the macronutrient analysis of their cultured chicken.

“The macronutrient profile is almost identical. In terms of the micronutrients. We haven’t released (the study) yet, as we haven’t checked all of them, but the ones that we have checked – it’s very similar [to traditional meat].” Shir explains. “And it makes it makes a lot of sense since the cells are the same [as a live animal]. The feed is very similar to at the end of the day. When we’re feeding an animal, when we’re buying meat at the store, around 70% of what we pay goes towards feeding the animal. [the feed] goes through the digestive system, so we don’t have a lot of control over what is going to end up in our meat. And right now, in Israel for example, we have to supply B 12 to the cattle because they’re also fed a lot of antibiotics and they’re under a lot of stress. So that impacts the meat quality. With cultivated meat, it’s very easy. Almost everything you put into the meat that you’re growing, will end up in your meat, because you don’t have to go through the digestive system of the animal.”

Wildtype, is a San Francisco-based start-up founded in 2016 by Justin Kolbeck and Aryé Elfenbein, a diplomat and a cardiologist respectively, producing sushi grade cultured salmon. Its cultured salmon contains the same omegas and trace elements like zinc and iron traditionally found in the fish, “We feed the cells the same concentrations that they would have within the fish,” Aryé Elfenbein explains. “When it comes to protein, we still have a way to go, we’re still a little below what is conventional salmon currently,” but this is something that the start-up is working on and improving continuously.

Growth media: the problem of foetal bovine serum

Originally the growth media used in cultured meat was foetal bovine serum (FBS).

FBS has been used for decades in a number of scientific applications, including stem-cell research, vaccine production and others that require cell proliferation. As the name suggests, FBS is harvested from bovine foetuses taken from pregnant cows without anaesthesia, during slaughter. The serum is not only not cruelty free, it’s also expensive. Prices vary according to type and application but 1L can cost over £1,000. Both the ethics behind FBS and its cost have pushed cultured meat and fish start-ups to look at growth medium alternatives, and most companies have managed to find or create non-animal growth media to replace the use of FBS.

Mosa Meat removed FBS from its process three years ago and replaced it with an animal-free growth medium.

“We proudly developed an animal free cell feed in 2019 and have now even told the world the recipe in a peer-reviewed paper written by our scientists, published recently in Nature Food.” says Robert E. Jones, Head of Public Affairs Mosa Meat. “We would not have moved forward as a company had an alternative to FBS not been identified.”

SuperMeat also say that using FBS wouldn’t make sense, and they now utilise animal-free growth media that they’ve created in house.

CULT Food Science Advisory Board member Rob Harris agrees. “There are so many alternatives out there that are actually sustainable and derived through better means now for growth medium that I think you’ll see everyone transition away from those traditional growth media into more sustainable ones and leaves.”

However, one type of growth medium isn’t necessarily fit for all cultured products. Lejjy Gafour, Chief Executive Officer at CULT Food Science explains:

“Every single company, depending on what types of cells they’re using, or product that they may be producing, might need something that’s a little bit different. You do see multiple start-ups, like [growth serum producers] Future Fields producing alternative techniques and approaches to eliminate the FBS problem.

“FBS was such a large catch all, but it was undefined. It just happened to work for absolutely everything. As you see these other start-ups – like ones that are in CULT’s portfolio – you’ll see that they will be adopting different strategies to approach both accessibility to different types of growth media mixtures or key components, like growth factors, to reduce the cost. It’s definitely not something where there will just be one solution that will cover everything. There’ll be multiple solutions and multiple winners, with that particular component.”

Robert and Lejjy point out that different types of cells, will respond differently to a particular ingredient, so a significant amount of time is spent testing and optimising different growth factor combinations to see how cells respond.

Basic nutrients such as salts and sugars like glucose are common building blocks in the total formula, but other ingredients will vary, depending on the product being worked on.

For Wildtype finding the right kind of growth media has had its challenging moments, as fish requires different nutrients compared to other types of meat. “When we started creating our cell line, the industry standard, which had been developed in the 1960s and 1970s, was to grow these cells with 20% bovine serum,” co-founder Aryé Elfenbein tells me. He explains that finding the right type of growth media to proliferate cells “is not a question of having to bend the laws of physics or, challenge fundamental cellular physiology, it’s just a process of understanding which nutrients the cells require, and then providing that in a non-animal component. In our case, we’ve grown our cells with [animal] serum and we’ve grown cells without [animal] serum. The challenge is that, at least in the beginning, the cells that are grown without [animal] serum in formulations that we’ve developed, that are completely animal component-free, don’t grow as well.

“The challenge is: how do we create that same animal component free media formulation, with the same amount of yield? We’re all going to get there, to a completely animal-free component, to an hyper-optimised, perfect nutrient formulation. I understand people’s consternation around an ingredient like this [FBS], and certainly we share that. We and others have been able to achieve [animal] serum free formulations. Now the challenge is to be able to scale that up and really have great yields with those formulations.”

In June the Good Food Institute Europe announced that it had partnered with EIT Food to launch a €100,000 prize aiming to bring down the cost of producing cultivated meat. Cultivated Meat Innovation Challenge will award up to four teams from around Europe €100,000 each for projects that can drive down the cost of cell culture media, in a bid to cut costs and move away from the use of FBS.

“Nobody actually wants to use FBS.” Seren Kell, Science and Technology Manager at GFI Europe tells me. “Not just because it involves the animal industry and it comes from this unpalatable source, but because it’s really, really, expensive.

“Because it comes from animals, you often have to use it with lots of antibiotics in it because it’s so prone to causing infections within cell culture. [Also] There’s no consistency in the actual composition, because the sources vary. It’s really hard to trace where it’s coming from, and global supplies are actually pretty limited.

“The medical research space has been trying to find alternatives to FBS for a long time. They do exist already, but the main problem is that all of these formulations haven’t been prepared or developed specifically for the cell types that are useful for cultivated meat. It’s also just unbelievably expensive. Obviously that is not at all appropriate or possible for cultivated meat on the kind of scale and quantities of the media that you would be using.”

More research is needed to find cheaper growth media solutions, Seren says, “but there are also other things we can do to reduce the reliance on cell culture, media or FBS, like the media recycling technologies, or working with cells so that they just require less media.”

For Kell governments have a huge role to play in investing in cellular agriculture research and drive prices of production down.

“Until governments are investing millions and millions of pounds into addressing these research questions, is going to be really hard to do this. Especially because so much of the research takes place in the commercial space, rather than academia, which means it’s all IP protected – it’s not open access – and its benefit doesn’t actually benefit the industry as a whole. Whereas if governments were investing into public open access research in universities, by academics, it would be much more effective. Research would be published, and then it would help the industry as a whole.”

Consumer acceptance and target market

How open will consumers be to trying cultured meat, fish and other products and who will the target market be? Has the public opinion changed compared to 10 years ago?

“I think initially, our customers are going to be people who are health conscious, who are curious about a product like this, who care about traceability and transparency in our food system,” says Aryé .

Rob Harris believes Gen Z will easily embrace cultured meat – a product very much in line with this generation’s ethical beliefs.

Mosa Meat’s Robert E. Jones agrees. “Consumers are more conscientious than ever about where their food comes from and how it impacts the planet.

“We are very encouraged by studies that show favourable attitudes among consumers towards cultivated meat: 88% of Gen Z, 85% of Millennials, 77% of Gen X, and 72% of Baby Boomers say they are open to trying cultivated meat.”

He adds: ”Our target customer is anyone who wants to continue eating delicious beef without guilt. The advancements in plant-based products are encouraging, but there is a sizeable segment of the population that are hardcore carnivores, and we need to make the switch as easy as possible for them in order to meet our global climate goals.”

“I assume the first wave would be the flexitarians and reducetarians,” SuperMeat Shir Friedman tells me “People who are trying to reduce their meat consumption, but don’t want to give it up completely. [Consumers will be] People who are interested in food and interested about learning where food comes from, and how you can produce it in a better way, for whatever reason. And then after that, it will gradually move towards your normal everyday meat lover.”

SuperMeat’s cultivated chicken burger. Credit: SuperMeat

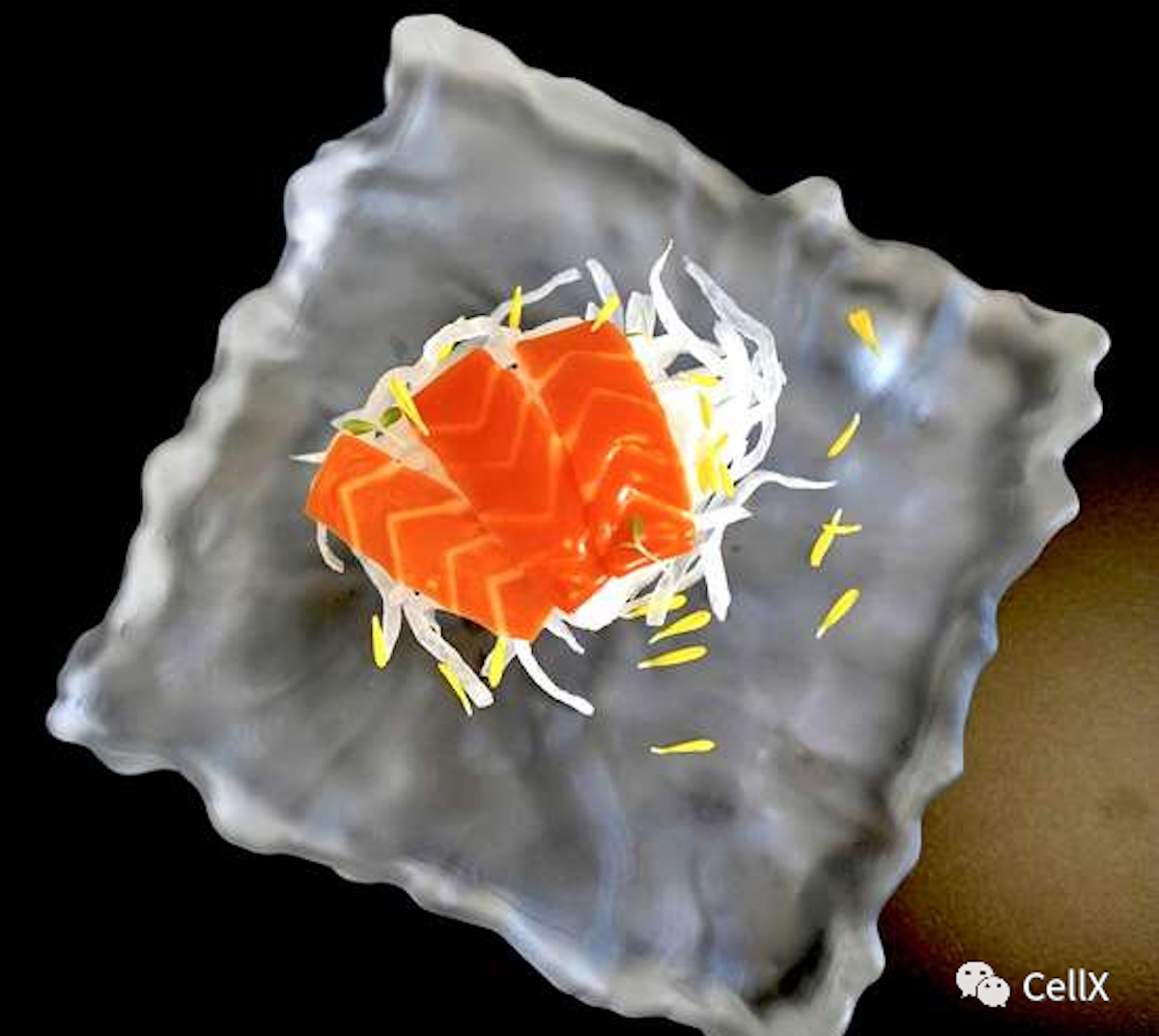

Sushi made using Wildtype’s sushi grade cultivated salmon. Credit: Wildtype

Left: SuperMeat’s cultivated chicken burger. Credit: SuperMeat

Right: Sushi made using Wildtype’s sushi grade cultivated salmon. Credit: Wildtype

SuperMeat have insight into public opinion of cultured meat, and specifically of their cultivated chicken. This year the start-up tested their product on the public, in what is believed to be the largest taste test ever done in the industry.

The company took to the streets of Tel Aviv in a food truck serving crispy chicken burgers to the public. Two options were on offer: one sandwich made with traditional chicken, one with their cultivated product. “We wanted it to be as objective as possible. So we didn’t reach out to the consumers. When they asked, ‘What are you handing out? What can I order here?’ We told them that it’s a crispy chicken burger, and that they could choose between two options of chicken production, one was traditional, and the second was cultivated. And if they had any questions about either of the options, we would hand out a flyer explaining each of the options.

‘We served over 100 people that day. And around 71.8% – if I recall correctly – chose the cultivated option, which to me, was the perfect result. We really wanted to prove that, first of all, consumers were not afraid of this option. They were all already very well educated about it.” Very few asked to see the flyer, most were aware of cultured meat. Those who chose to eat the traditional chicken burger said they did so because they weren’t feeling adventurous that day. “Which is good because that’s also something that you expect, because people like what they like and are used to what they’re used to. It just comes to show that with cultivated meat, you expect that once it hits the market. I assume, that there will be an initial big wave of people who are very curious about it and want to see what it is. And then after that, it will be a slow and gradual process, as other consumers will start testing it out and kind of converting a certain percentage or all of their diet into cultivated meat.”

In their facility, SuperMeat have a test kitchen that functions as a restaurant too, aptly named The Chicken. The restaurant boasts an open kitchen, where punters can watch the chefs in action. Those interested in trying the product, have to apply to sample it.

“We launched it about two years ago now.” Shir says. “Back then it was the first of its kind, where we had the glass wall that would separate the restaurant, from the factory that produces the meat. It was important for us for two reasons: one for diners to actually get familiar with the meat that they’re eating and have their questions answered, and secondly, to learn about the production process as we are reaching commercialisation”.

The Israeli start-up currently have around 10,000 applications from people wanting to try their product. “It’s a lot of applicants from all over the world from different people: from meat loving chefs, to hardcore vegans – everybody. When people come in to dine – I always thought they would rush to the tables to try the meat first – but they usually go straight to the glass window, and look at what’s going on inside the factory and start asking a ton of questions.”

For Seren Kell studies have shown positive results: “We’ve had a few different surveys done by academic researchers, and they have generally been very positive. For example, in the UK 80% of people would be open to buying and eating cultivated meat. The UK, Germany and the US In general – especially younger consumers – care about it and understand the environmental and the public health concerns. They really are interested in trying it and would want to have access to it.”

The importance of transparency in the cultured meat space

CCTV cameras have been mandatory in abattoirs in England since 2018, and in Scotland since July 2021. In Wales close circuit cameras are due to come into force in 2023/2024.

Intensively farmed animals are some of the most vulnerable on the planet. Footage secretly filmed by animal activists has unveiled the horrific conditions these animals live in, as well as the appalling treatment they have to endure before slaughter. It’s not surprising that the meat industry wants to keep the public as unaware as it possibly can about its practices.

Cultured meat start-ups want the exact opposite: full transparency.

Several not only have glass walls in their facilities, that resemble breweries rather than abattoirs or fictional ‘mad scientists’ labs’, but they also welcome visitors to take tours of their plants.

Just as SuperMeat allow visitors into The Chicken and their facility, Wildtype welcome them in their factory in San Francisco.

Located in an old industrial shipping port, the plant features ‘The Dock’, a space used for company events and as a tasting room with a sushi bar where visitors can sample Wildtype’s produce. The start-up has also opened a waiting list. Those interested in sampling their cultured salmon can sign up in the hope to be selected. Wildtype also did a tasting of their product in New York City last spring, which was very well received by journalists in attendance.

“Our neighbours know [about what we do], and they’ve talked to other people [about it] and that’s the kind of thing that we’ve we set out to create,” says Aryé “And anytime somebody comes in, or walks by with their dog to see, we show them what the brewery looks like and tell them this is what we’ve been doing. And really that’s the intent there.”

CULT Food Science Rob Harris concurs: “We have to, as an industry always maintain an authentic touch and an authentic push towards our Gen Zed consumer base and say like, ‘Here’s the information, here’s how this is made.’ After discussions about transparency with the start-ups on its portfolio, the investment company agreed about the importance of being an open book. ‘I want anyone who comes into this facility to see what we’re doing. This isn’t like a closed door [where] only the top-secret people get in. Go to a kill facility, see if you can get into the kill floor. It’s not happening, right? The media is not allowed on premise.”

For Rob, knowledge will empower their future customers – Gen Z – to make an educated choice and spread the word: “If you can arm the early adopters of Gen Z with the appropriate information, I’m hoping that they do the rest. I’m hoping that they as a generation do what they’re absolutely known for, which is disseminate this information so incredibly fast that it doesn’t matter what happens at a policy level anymore, because they’ve already done the hard work. They’ve educated themselves.”

Cultured meat and its relationship with the traditional meat industry

Although there were concerns that the traditional meat and fish industry lobby might push back against the commercialisation of cultured meat and fish, the reality is many food giants have embraced it as a new profit stream.

“We’re a b2b company,” Shir tells me. “We’re planning to licence our technology to the traditional meat industries of the world. We already have a few of them on board with us, including PHW group, which is one of Europe’s largest poultry producers. We are planning to licence this technology to them so that they can have this set of tools and produce the meat that their consumers love slowly and gradually”.

In July SuperMeat signed a Memorandum of Understanding (MOU) with Migros, Switzerland’s biggest supermarket chain and meat manufacturer. The Swiss food giant has also invested in the start-up as part of the agreement. The companies will now work together to develop the necessary infrastructure to produce and eventually sell lab-grown chicken on a wide scale.

Mosa Meat and Wildtype too have had positive responses. “We actually have a lot of support and even investors from within the conventional beef supply chain.” Robert E. Jones tells me. “People recognise that the current system is not working and even the largest meat companies in the world have started divisions focused on alternative proteins. Cellular agriculture, in combination with reforms to conventional practices, will give us an opportunity to mitigate the climate change impacts caused by agriculture and that is something that everyone can support.”

“It’s been fascinating to me to speak with fishermen and fisherwomen whose livelihood depend on fishing.” Aryé says. “It was astounding to me to see how supportive they are. The reason – which didn’t occur to me at first – is that it’s the large commercial fishing operations that are mostly responsible for the problems of sustainability. In other words, pulling too many fish out of the water. In the case of people who are true stewards of the oceans, who care about the numbers of fish that come out, so that in subsequent years, they can still have a livelihood – these are people who just see the intense increase in demand and recognise that just pulling more fish out of the water isn’t going to solve the problem long term. It’s been very heartening to see the allies that we have along the way in places that we wouldn’t expect. So that hasn’t been a problem for us so much in terms of resistance from incumbent conventional seafood producers.”

The Good Food Institute Europe’s Seren Kell also points out how conventional food companies are embracing the cultivated meat technology. She mentions cellular aquaculture start-up BlueNale, currently working with frozen food company Nomad Foods and Brazilian JBS, the largest meat processing company, investing in biotech foods. “Based on what we’ve seen so far,” she tells me, “you might have expected that the incumbent animal agricultural industry would be really against cultivators, but if you actually look at who is putting money into cultivated meat, and who is investing in it and acquiring it, taking it seriously and doing research and development, conventional agriculture is really heavily involved, as well as other actors in the food supply chain. So the distributors, the middlemen, the ingredient suppliers, the people who develop the final products, all of them are taking a really big interest in cultivated meat.”

From plant to plate: approving cultured meat for human consumption and commercialisation

Several cellular agriculture start-ups have received substantial investments. In February Wildtype secured $100M in a Series B funding round, the biggest amount raised in a round by a cultured seafood company. Investors include L Catterton, a consumer growth investment fund, Temasek, S2G Ventures Oceans and Seafood Fund, food producer Cargill, Amazon’s founder Jeff Bezos’s Bezos Expeditions, as well as actor Leonardo DiCaprio, Iron Man star Robert Downey Jr.’s environmental research group FootPrint Coalition, renowned chefs and famous names in the world of sport.

Israeli cultured meat company Future Meat raised $347M in funding, marking the largest investment gain in the food-tech start-up industry in Israel.

British cultivated meat company Ivy Farm recently unveiled a new pilot manufacturing plant in the UK for scaling and developing its cell-based products. The facility is said to be the largest cellular agriculture plant in Europe.

Recently the Dutch government announced it was investing €60M in cellular agriculture and the Netherlands’ House of Representatives approved a new law to make the sampling of cultured meats legal in the country.

In April the Israel Innovation Authority (IIA), an independent publicly funded agency, announced an investment of $20.4M over three years to establish a consortium of companies and organisations focused on cell-based meat innovation, the Israel cultivated meat consortium.

However at the time of writing, Singapore is still the only country that’s approved the commercialisation of cultured food products.

Like all novel ingredients, cultured food has to go through a rigorous process and start-ups have to submit a dossier to a regulatory body, such as the European Commission, the EFSA in Europe and the FDA in the US, before their product is approved for human consumption and commercialisation.

The process can take years. Dr Hans Verhagen, Food Safety and Nutrition consultant and former Head of the Risk Assessment and Scientific Assistance Department as well as a Senior Scientific Officer at EFSA, tells me that the timeline for approval, if a product is indeed approved, can vary. “The applicant needs to make a dossier. Upon submission of the dossier, the European Commission has 30 working days to validate the dossier and send it onwards typically to EFSA and to the [EU] member states for notification. EFSA, upon submission by the Commission, has nine months to issue a scientific opinion and publish its scientific opinion. Those nine months can be extended in case there are questions asked and EFSA can apply a so-called ‘stop-the-clock’ procedure. So that’s another nine plus months upon finalisation of the evaluation by EFSA. So in the nine months period they need to literally read what the Commission says. Within the seven months from the date of publication of the EFSA opinion, it goes to the standing committee. And once the act has received a favourable vote from the standing committee and is adopted and published by the Commission, the novel food can be lawfully placed on the European market.” That is of course if the novel food receives a favourable response. If more clarification is needed by the governing body, approval can take longer.

At the time of writing there are no cellular agriculture applications submitted to the European Commission.

Despite the large investments in cultured food products, Israel is nowhere near approving any. “When it comes to the percentage of cultivated meat companies per capita, we are one of the highest in the world, but when it comes to the regulatory authorities here, they’re kind of slow, and they haven’t been really looking deep into cultivated meat yet.” Shir tells me “I assume what’s going to happen is that the regulatory authorities are going to look at what the US is doing and then kind of follow along.

“Unfortunately, I don’t think Israel is going to be one of the first countries to regulate cultivated meat even though it’s been blooming. Everybody here is very well educated on the topic and very excited about it. But I believe that as Singapore obviously was the first [to approve cultured meat] the second would probably be the US and then Europe.”

Wildtype has been in talks with the FDA, but many believe that technology is moving much faster than policy. “The FDA put out a public opinion piece, they asked for industry feedback, as an industry, we did reply and gave them some feedback,” Rob Harris says. “I think, in a classic Silicon Valley way, the big guys are doing what they do best, which is they’re going to force the issue. Upside Foods is a good example. They went ahead and they said: “I don’t care if this is going to be approved or not, I’m building this facility because I’m going to force the FDA to act, because I’m going to start producing the product’.

“They’ve always been such dreamers in Silicon Valley, where they’re like: ‘No, we can do this, regardless of what happens next. This is too important not to make this happen.’ And I think they kind of took that ‘can do’ attitude, and they’re going to force the FDA to come to the table in a meaningful way this year to say: ‘There’s our product, you can touch it, you can feel it, you can see how it’s produced. What are you going to do about it? Are you going to say this is good to go? Or do we have to make revisions?’ But ultimately, they’re pushing them at a cadence that maybe the FDA wouldn’t do on their own.”

Cultured meat, fish, dairy and honey might not be on our plates tomorrow, but with major investments from companies and food giants, these products could potentially be on our plates in the next two to five years.

Whilst at the beginning most start-ups were European, American or Israeli, other countries are following suit. China might have joined this space later, but now boasts companies like Joes Future Food and CellX, who in September 2021 showcased its cultured pork and 3D bioprinted salmon prototypes for the first time in Shanghai.

South Africa too has joined the ecosystem. Start-up Mogale Meat announced last April that it had successfully created the first cell-based chicken in Africa, following 18 months of R&D work.

More biotech companies producing non animal derived growth media are also appearing in the cultured meat space, such as BioBetter, who has just received $10M in investment to scale development of cell growth factors made from tobacco plants.

The production costs of lab-grown products have also hugely decreased compared to 2013, when Mark Post unveiled the first cultured meat burger which cost $330,000.

Whilst still not quite at the same price level as supermarket meat, the current price of lab-grown meat and fish hovers around the price point of a high-end restaurant, where, once cultured meat and fish are approved for human consumption and commercialisation, will probably be first sold.

“I think initially, we will be selling to restaurants, because the greatest ambassadors of a product like ours are people who speak the language of food, and those are chefs, people who really communicate through food in a way that you don’t have at the supermarket,” says Aryé Elfenbein. “But certainly, we’re not going to be able to achieve the kind of impact that we’ve set out to, to achieve if we limit ourselves to fancy restaurants. And so very soon after that, we envision a transition to retail.”

With new technologies being developed continuously to drive price down and make the use of FBS obsolete, start-ups receiving large investments to scale up production, food giants driving innovation and opening up opportunities in the cultured meat space, and governments getting involved, eating products derived from animal cells, rather than from slaughter, might become the new normal for young and future generation. Perhaps we will realise that ‘Frankenmeat’ is not the meat grown from stem cells in a facility, but it’s what is on our plates now, made in factory farms, where animals are forced to grow at an abnormal speed, crammed in tiny spaces, fed antibiotics, and slaughtered at a young age.

Wouldn’t meat that doesn’t impact the environment, that’s not sourced by causing unspeakable pain to animals, and is not full of antibiotics be a better option, both for humans and the environment?