The ‘start-up nation’: the ecosystem of Israel’s foodtech sector

Twenty twenty-two looks set to be a revolutionary year for food technologies with Israel positioning itself at the forefront of innovation.

The ‘start-up nation’ has become a tasty hub for the intersection of food and technology, aka foodtech, with investment into Israel’s booming sector increasing from $53 million in 2015 to $866 million in 2021, according to IVC-MEITAR Israeli Tech Review 2021 report.

The World Bank estimates that the global food and agriculture industry is valued at over $8 trillion and makes up more than 10% of the global GDP, so there are huge opportunities for innovation and technology in these industries.

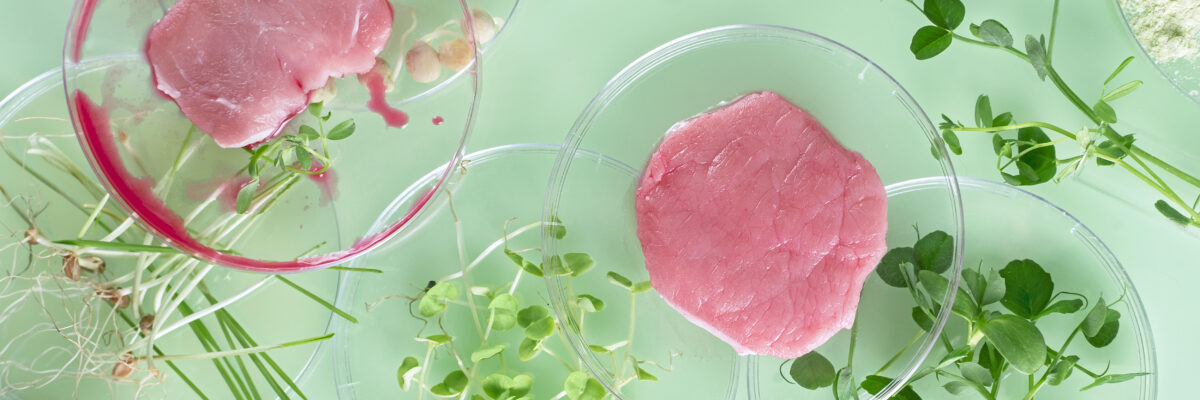

Foodtech covers an array of areas that includes nutrition, packaging, food safety, processing systems, cultured meat, novel ingredients, retail and restaurant tech, health and wellness, and alternative proteins.

Israel, the land of foodtech start-ups

Israel is home to over 400 foodtech companies, around half of which were founded in the past five years.

So how has Israel managed to position itself as a world-class leader in the field in a relatively short space of time?

Hadar Huberman, the Clean Growth Sector Lead at British Embassy Israel’s UK Israel Tech Hub team, which has been working with leading UK corporates to find disruptive solutions around food technology and sustainability in Israel, explains: “Decades of expertise in agriculture research and innovation, including plant genomics and plant-based proteins, created a strong foundation for foodtech innovation. This, combined with deep tech knowledge from other tech sectors such as biotech, sensors, data analytics, and IoT, has positioned Israel with an advantageous toolkit to disrupt the field.

“The fact that Israel is a very small country where everyone knows one another, helped assembling the right team, which in the foodtech sector, requires expertise from multiple fields such as chemistry, biology, physics, artificial intelligence, robotics, computer vision and more.

“But it takes more than just having the knowhow and the right group of people to form a successful foodtech company,” continues Huberman. “You need the entrepreneurs to look at foodtech as a sector where they can scale up their idea, and for that you need funding. The classic Israeli entrepreneur would target investment-attractive fields such as cyber and fintech, but in recent years, entrepreneurs have a growing desire to generate an impact on the environment and humanity’s health. The fact that food security and food-effected health concerns are at the heart of the global agenda, started an inflow of capital to the sector, which provided certainty for the entrepreneurs to start chasing their foodtech idea.”

Hadar Huberman, the Clean Growth Sector Lead at British Embassy Israel’s UK Israel Tech Hub team

Jonathan Morris, a Partner and Co-leader of the Israel Practice and the Food and Agribusiness Practice at Bryan Cave Leighton Paisner (BCLP)

Left: Hadar Huberman, the Clean Growth Sector Lead at British Embassy Israel’s UK Israel Tech Hub team

Right: Jonathan Morris, a Partner and Co-leader of the Israel Practice and the Food and Agribusiness Practice at Bryan Cave Leighton Paisner (BCLP)

Jonathan Morris, a Partner and Co-leader of the Israel Practice and the Food and Agribusiness Practice at Bryan Cave Leighton Paisner (BCLP), says: “It’s a combination of food forming a critical element of Israeli culture and the country being a well-established hub for technological innovation. Israelis are very good at thinking outside the box, a quality that is very important in the foodtech sector.”

Israeli foodtech has become an appetising prospect for global investors, attracting money from some of the world’s largest food corporations such as Coca-Cola, Mars, Mondelez, Tyson Foods, Nestlé, Danone, AB inBev, Starbucks, PepsiCo, McDonalds, Heineken and Unilever.

Public and private record investments in Israel’s foodtech

At the end of last year, Future Meat Technologies, which produces cultured meat, secured $347 million, marking the largest investment in the foodtech start-up industry in Israel so far and the largest for cultivated meat globally. While Israeli cultured meat Aleph Farms has completed a $105 million Series B financing round led by the Growth Fund of L Catterton, the largest global consumer-focused private equity firm, and DisruptAD, one of the largest venture platforms in the Middle East, and Remilk, which produces animal-free milk and dairy products by generating milk proteins via a microbial fermentation process, raised $120 million this year in its Series B – the single largest investment in a cow-free dairy company to date.

According to a recent report by The Good Food Institute (GFI) Israel, the Israeli alternative protein sector alone raised $623 million last year, a 450 percent increase from 2020’s $114 million. Israel came second, behind the US, in terms of total value of investments secured.

There are more than 100 alternative protein companies in Israel – over 40% are considered start-ups with breakthrough technology that could shape the future of protein, according to the GFI Israel report.

Government-backed initiatives, local VC firms, food makers and have all been providing capital needed to advance the country’s eco-system.

Jerusalem Venture Partners (JVP), founded in 1993 by Erel Margalit under the famed Yozma program, has invested in around 150 companies in Israel, the US and Europe. With a reported $1.5 billion raised through eight funds, JVP has led some of Israel’s largest and most noteworthy exits. In 2019, it partnered with Mars to foster innovative tech solutions for global food, agriculture and nutrition challenges.

There is also Osem, owner of the Tivall brand, one of the first manufacturers to introduce meat substitutes to the market and the Neto group – an investor in Future Meat Technologies.

The Israeli government recognises the area as a growth opportunity, notes Huberman.

According to Invest in Israel, a report by the Ministry of Economy and Industry, the government has targeted the north of Israel and the Galilee region as the main geographic zones for government investments and via four main areas: the establishment of Israel’s first foodtech industrial compound – The National FoodTech Centre – in Kiryat-Shmona, the establishment of a new foodtech research centre as part of the compound in addition to the formation of the Sparks’ Fresh Start Incubator, a government-backed incubator for food technology, led by some of Israel’s largest food corporations as well as various food-tech VCs, and the ‘high salary plan’, managed by the Ministry of Economy and Industry. The plan provides subsidies to high-tech companies that employ workers at high salaries.

Perhaps one of the most significant and original incubators in the country is renowned The Kitchen FoodTech Hub. Founded in 2015 by the Strauss-Group as a part of the Israeli Innovation Authority incubators’ program, The Kitchen addresses global food challenges by harnessing Israel’s renowned innovation eco-system. It has raised over $222 million in capital, creating more than 250 jobs and comprises a portfolio of 22 companies across a range of foodtech areas.

Also part backed by the government is the Tnuva Group, one of the largest food groups in Israel. Tnuva is part of the consortium that was selected to establish the Sparks incubator, alongside Tempo, and the investment funds OurCrowd and Finistere Ventures.

Tnuva has launched a venture capital fund focused on investments in new foodtech companies. Tnuva NEX, adds to the company’s investments in foodtech ventures which reportedly totalled some NIS 30 million ($9.28 million) last year and the company expects to invest approximately the same amount in 2022, according to reports.

Tnuva has already invested in Israeli cultured milk company Remilk and formed a joint venture with Pluristem to establish a cultured food platform.

But is the government’s commitment enough to future-proof the sector and ensure foodtech becomes a superpower to rival the country’s cyber security and fintech sectors?

Shani Netzer, Business Development Consultant in BCLP’s Tel Aviv representative office, says “it’s not nearly enough according to various voices emanating from the sector. The Israel Innovation Authority announced last year that it had earmarked NIS 220 million ($68M) to establish four new consortia in the fields of cultivated meat, insect farming, fluid sampling for medical diagnosis and human-robot interface but, given the size of this expanding sector, the amount is relatively small.”

Shani Netzer, Business Development Consultant at BCLP, Tel Aviv

The Kitchen FoodTech Hub. Picture: Facebook

Left: Shani Netzer, Business Development Consultant at BCLP, Tel Aviv

Right: The Kitchen FoodTech Hub. Picture: Facebook

According to a separate report by the Good Food Institute (GFI) Israel, and consulting multinational EY, about NIS 1.4 billion ($450 million) will be required over the next 10 years to build the infrastructure to support the local industry in the form of multidisciplinary research centres, technology transfer programs (from university labs to industry), research grants and training, and an additional NIS 230 million ($74 million) should go toward building specific innovation hubs for cultivated meat, plant-based proteins, and fermentation tech start-ups. It said the Israeli government should supply 56% of this funding, or almost NIS 900 million ($291 million), and the rest should be drawn from private investments in Israel and abroad, according to the report. The researchers estimated that, through the establishment of more foodtech companies, the creation of thousands of jobs, possible future acquisitions, and foodtech exports, the government could stand to gain NIS 26 billion ($8.4 billion) in tax revenue.

The Israel Innovation Authority has just approved the establishment of the cultivated meat consortium, one of the biggest in the world, to invest in cell-based meat.

Together with the business sector and academia, NIS 66 million ($20.4) will be invested in the consortium over three years, half of the sum by the government. Market sources believe that the total amount invested may eventually be more than NIS 70 million ($21.6).

The consortium will be led by Israel food giant Tnuva and comprise 14 companies and 10 academic laboratories. Consortium members will also include Aleph Farms, SuperMeat, the Hebrew University of Jerusalem and Tel Aviv University. One of the main aims of the consortium is to connect between academia and industry and bring academic research about cultivated meat ‘down to earth.’

Israel cultivated meat companies raised $507 million in 2021 led by Future Meat, which raised $347 million for a production plant in the US, and Aleph Farms, which raised $105 million.

A long-term strategy is needed to ensure Israel remains in poll position. But it is still early days for the foodtech revolution. With the strong appetite coupled with concerns over environmental challenges, healthier ways of living and tech prowess, surely it won’t be long before Israel’s flourishing foodtech sector becomes a global powerhouse. It’s certainly on its way.