China’s alternative protein sector: rapid expansion and innovation

2020 is widely regarded as the year in which China’s alternative protein industry underwent a rapid development thanks to the large amounts of financing and investment poured into the sector during this period. According to the latest statistics from QCC (China’s local database for business registration information), a total of 15 plant protein start-ups received investment, for a total amount valued at CNY1.563 billion (£183.2 million). The same year also saw a 650% increase of newly launched start-ups compared to 2019.

Such investment spree was mainly driven by the investors’ high expectation of the potential market size of alternative protein in China. As per the latest official data available, there are around 50 million vegetarians and vegans in China. But the market potential of China’s alternative protein sector is likely to be larger than this figure, as most local plant-based meat start-ups are not just targeting vegans and vegetarians, but also non plant-based young professionals, who are looking to adopt a healthier and more sustainable lifestyle and want to reduce their meat consumption and consume more plant-based alternatives. This type of consumer is exactly where the growth potential for this market is.

2021 saw both China’s plant-based and cell-based meat sectors continue to grow, and with it an increase in competition.

Besides numerous alternative protein start-ups which sprang up with strong financial and technical support from domestic and overseas venture capital funds, established local animal protein and vegetarian companies have also been seizing the opportunity to expand their product portfolio and grab a share of this emerging market.

Sulian Food: scaling up technology and innovation

As one of China’s top three vegetarian companies, Sulian Food does not rest on its laurels. Instead, it keeps up pace with the market trends and it’s seizing the opportunity to expand its offering, with new fully plant-based meat product launches.

Sulian Food’s plant-based chicken nuggets

Sulian Food’s plant-based meatballs

Left: Sulian Food’s plant-based chicken nuggets

Right: Sulian Food’s plant-based meatballs

Using its R&D expertise and technology, Sulian is further developing China’s first integrated moisture protein extrusion machine to create plant protein powder, moulding, colour modulation and seasoning. Developing this machine in-house means that Sulian saves over 90% of what it would cost the company to import a similar type of equipment, further reducing the production costs of its plant-based meat offering and allowing it to create a larger variety of products in the future.

Sulian developed the first plant-based beef pieces as early as 2011. Since then, the company has kept launching at least one new plant protein product each year, ranging from plant-based ham sausages, meat stuffing, luncheon meat, pork belly, bacon, meatballs, burgers, steak, and barbecued pork, to tuna and mashed shrimp.

Sulian Food’s plant-based bacon

Sulian Food’s plant-based tuna

Left: Sulian Food’s plant-based bacon

Right: Sulian Food’s plant-based tuna

In addition to supplying more than 100 SKUs to domestic temples, vegetarian and non-vegetarian restaurants and supermarkets, Sulian is currently the only Chinese company exporting plant-based bacon, nuggets, luncheon meat and tuna to overseas markets.

Starfield: multi-channel sales and flexible pricing strategies

On 11 January, 2022, Starfield announced it had raised $100 million in its Series B funding round – the largest financing amount in China’s alternative protein industry so far. This is also the fifth-round of investments that Starfield has completed since the company was set up in 2019. Key investors include Primavera Capital, Sky9 Capital, Matrix Partners China, Joy Capital, Lightspeed China Partners and Ming Zeng (Alibaba’s Strategy Chief).

Different from many alternative protein companies that focus only on the foodservice sector, Starfield works both in the foodservice and retail arenas, focusing on the end consumer’s demand. Up to now, the company has partnered with over 100 brands, and sells its products across 14,000 outlets nationwide, such as new-style tea chains Nayuki and HEYTEA, local coffee chain Luckin, fast food chain Dicos, restaurant chain KWEI MUN LUNG, convenience stores FamilyMart and LAWSON, and numerous exclusive and trendy restaurants.

On one hand, through supplying customised plant-based meat products such as chicken burgers, minced pork, meat patty and meatballs, to foodservice operators, Starfield could rapidly build brand awareness among targeted consumers and gradually expand the brand’s influence. On the other hand, by displaying and selling their products in convenience store giants like FamilyMart, LAWSON and 7-Eleven, Starfield further establishes itself with Generation Z and young professionals, which fits with the company’s targeted groups.

Starfield’s plant-based pasta with meatballs sold at FamilyMart CNY13.8

Starfield’s meatballs with rice are sold at BRUT EATERY for CNY49

Left: Starfield’s plant-based pasta with meatballs sold at FamilyMart CNY13.8

Right: Starfield’s meatballs with rice are sold at BRUT EATERY for CNY49

Furthermore, Starfield adjusts its pricing strategies to different application scenarios and consumer groups. For example, the retail prices of its plant-based meatballs in FamilyMart and BRUT EATERY differ enormously. The plant-based meatball pasta at FamilyMart is priced at CNY13.8 (GBP1.60), while at restaurant BRUT EATERY their meatballs with rice cost CNY49 (GBP5.70), 255% more expensive. The main reason is that FamilyMart, as a convenience store, is positioned as accessible and affordable, while BRUT EATERY is a mid-range restaurant, targeting the middle-income class, who leads a busy and sociable life and has more disposable income. By following such flexible pricing strategies, Starfield could reach as many consumer groups as possible and create brand recognition in a short period.

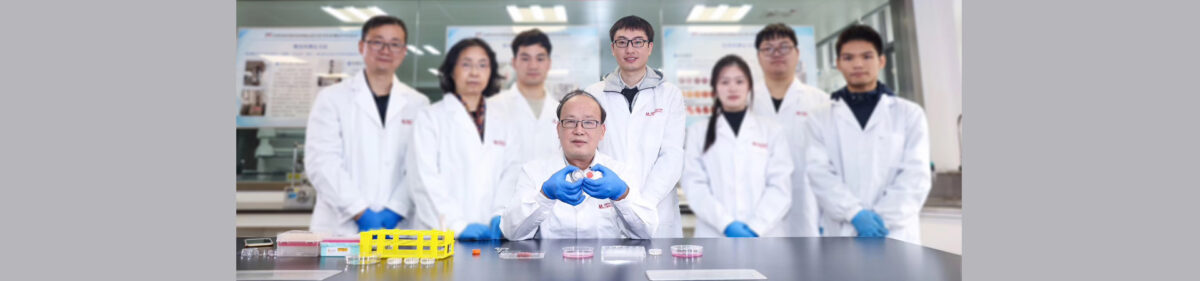

Joes Future Food: the pioneer of China’s cell-based meat

Joes Future Food is regarded as the leader in China’s cell-based meat sector since the company announced on 18 November 2019 that it had successfully developed the first lab-grown meat in the country. But its first involvement in this area can be traced back to 2009, when the R&D team, led by Professor Zhou Guanghong of Nanjing Agricultural University, started researching how to create in vitro meat production through differentiation of stem cells.

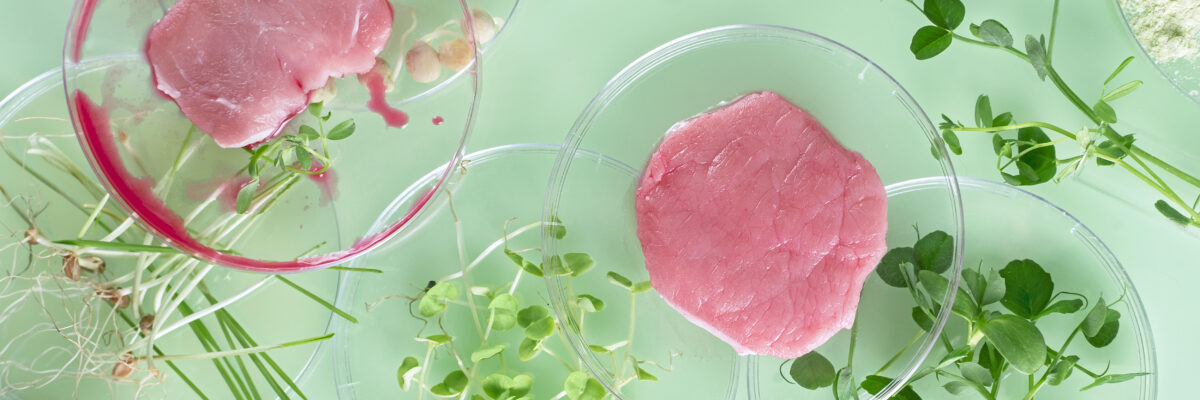

Joes Future Food’s cell-based meat

Joes Future Food’s cell-based meat

With a mission to kickstart green and low-cost production of cultured meat in China, by October 2021 the company had raised a total of CNY70 million (just over £8M). Investors include GL Ventures, Matrix Partners China, Crystal Stream Capital and Nanjing Innovation Capital. The investment will be used to accelerate the production and commercialisation process of cell-based meat in China.

In addition, the 14th Five-Year Plan for the Science and Technology Development of National Agriculture and Rural Areas, published by China’s Ministry of Agriculture and Rural Affairs in January 2022, mentioned for the first time cultured meat as one of the key food areas in need of development. Chief Scientist of Joes Future Food, Professor Zhou Guanghong, was invited to offer suggestions for the Five-Year Plan.

CellX: cell-based meat sector’s rising star

Due to technical and expertise barriers, there are much fewer start-ups in the cell-based meat sector than in the plant-based one. Unlike Joes Future Food, which has strong scientific expertise and local governmental support, CellX started developing lab-grown meat from scratch in 2020. However, the company is catching up quickly, both in terms of fundraising and product development.

On September 3, 2021, CellX showcased its cell-based meat prototypes for the first time in Shanghai. These included deep-fried parcels filled with minced pork, pork pieces, meat strips, and a 3D bioprinted salmon prototype.

CellX’s meat strip prototype

CellX’s bioprinted salmon

Left: CellX’s meat strip prototype

Right: CellX’s bioprinted salmon

Thedeep-fried parcels filled with minced pork (a traditional Chinese dish) prototype is closest to be made available commercially due to its lower production costs and the simpler type of technology used to create it. The product combines the muscle cells from black pigs with plant protein.

The pork pieces and meat strips demonstrates CellX’s achievements in the scientific research area. CellX is China’s first company to display the application of biological scaffolds technology to the cell-based meat sector. In addition, its 3D bioprinting technology could also meet the customisation demand for meaty textures.

CellX’s deep fried minced pork parcels

CellX’s cultured piece of pork

Left: CellX’s deep fried minced pork parcels

Right: CellX’s cultured piece of pork

By August 2021, CellX completed its angel round of funding, raising tens of millions of RMB in total. Including the seed round, its investors include Agronomics, Purple Orange Ventures, Humboldt Fund, ZhenFund, Sky9 Capital, K2VC, and LEVER VC. The raised funds will be used for further reducing production costs and scaling up production.

The CEO of CellX Yang Ziliang told me: “We aim to develop two types of products in the near future: high value-added seafood, and pork, the most consumed type of meat in China. But considering the legislative approval from the local government, it could take one to three years for the sale of our products to reach the public.”

2022: opportunities and challenges

Opportunities always coexist with challenges. When numerous plant-based and cell-based meat start-ups sprang up like mushrooms in 2020 and 2021, many thought that the industry would develop rapidly. However, with the emergence of alternative meat products on the Chinese market, the feedback from local consumers has not been all positive. Some think plant-based meat products are too expensive and they would rather buy real meat, which costs the same or less; others disagree with claims that plant-based meat is healthier than animal meat, because the vegan version is often over processed. Consequently, consumer feedback can have a negative impact on the sale of plant-based protein alternatives, and on investment.

The primary goal for most start-ups in this industry in 2022 is to survive first, and then to succeed. For both the plant-based and cell-based meat sectors, there are many vertical breakdowns in the production and supply chain: raw materials, processing, product formulation and innovation as well as distribution. Only by prioritising one specific area of the chain first, can a start-up produce successful products and advance its technology. Like Starfield, companies should focus on establishing partnerships with existing successful businesses first, being in the areas of raw materials, formulation or distribution, rather than doing it all alone. This strategy could prove beneficial for the growth of the Chinese alternative protein market as a whole and could help start-ups achieve their long-term development goals.